Finance and Markets

US jobless claims still high

US jobless claims still high

Initial claims may have dropped from the 500k mark three weeks ago but they remain too high at 478k and 472k the past two weeks, according to DBS Group Research.

China Manufacturing PMI rebounded to 51.7 in August

Morgan Stanley believes the modest rally (from 51.2 in July) can be explained partly by seasonality.

China: Retail sales going up

DBS Group Research said China’s retail sales growth is higher than it’s been in a decade.

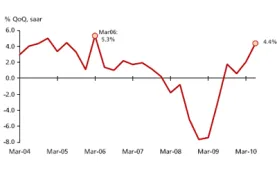

Demand in the US accelerates

DBS Group Research said demand in the US is accelerating, even without including inventories or government spending in the picture.

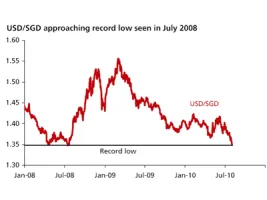

USD-SGD expected at 1.3450-1.3520 range

The better-than-expected PMIs boosted global risk appetite, according to OCBC.

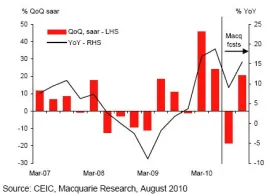

Banks loans to accelerate

OCBC said bank loans are expected to accelerate further from 9% yoy in June to 11%, crossing into double-digit growth territory for the first time since February 2009.

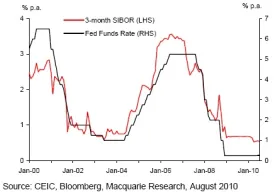

Singapore: Further tightening could push rates lower

Macquarie Research believes MAS is unlikely to tighten monetary policy again in October.

Singapore: Difficult to derail 2010 growth momentum

Macquarie Research says with increases in pharmaceutical output capacity and the strong momentum in the service sector that could cushion the fall-out, contraction previously forecast may not come to pass.

MAS to auction $2 billion of 20-year SGS bond

On 27 August MAS will auction $2 billion of a new 20-year SGS bond with effective issue size of only $1.8 billion.

USD-SGD rises to 1.3638

The USD-SGD is currently around the 1.3600 mark as global risk appetite remains curbed by US data and Ireland’s downgrade, according to OCBC.

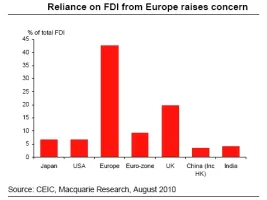

Singapore: Reliance on FDI from Europe raises concern

According to Macquarie Research, growth outlook appears vulnerable in terms of investment, with nearly half of Singapore’s cumulative net inflows of foreign direct investment from 2005 to 2009 coming from Europe.

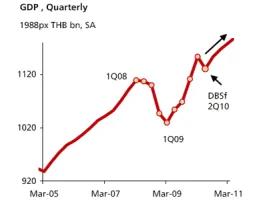

Thai GDP on tap

Consensus and expectation are for a 6.0% drop in output which translates to 8.0% year-on-year growth.

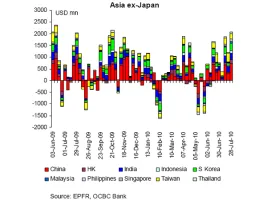

Massive flow of foreign money into Asian stocks, Bonds

OCBC Bank is reporting a massive flow of money into Asian stocks and bonds over the last week, which is one factor behind the continued strength of the Singapore dollar.

SGD approaching near record high against USD

The Singapore dollar is now being closely watched, with the market showing preference to stay invested in Asia.

Advertise

Advertise

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)