China Manufacturing finally slows down

Still growing, but down to a 10 month low.

Here's a report by HSBC:.

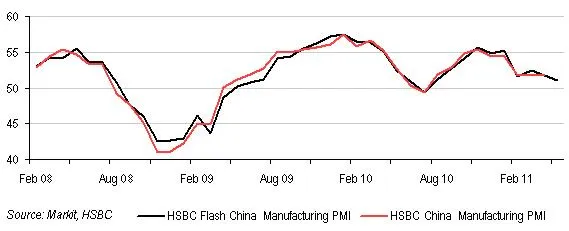

| May's HSBC Flash China manufacturing PMI eased further to 51.1, its lowest since July 2010. Manufacturers continued to destock in response to slowing new business flows, slowing production growth to a 10-month low. That said, the current level of PMI is still consistent with IP and GDP growth rates of around 13% and 9% respectively. Beijing's policy focus is still directed at taming inflation, something which we expect to remain in place in the coming months. After stabilizing at a level of 51.8 for the March-April period, May's HSBC Flash China Manufacturing PMI decelerated to a 10-month low at 51.1, well below the series' long term average of 52.3. This flash PMI release is the first for China's May leading indicator, and heralds further cool down of the world's second largest economy as both domestic tightening and external supply disruptions kick in. Looking into the breakdown, slower growth or outright contraction was observed across the board, except for employment growth which stayed flat at 51.2 for the second consecutive month, above the series' long-term average of 50.6. New orders continued to soften to 51.9 in May (from 52.7 in April), its lowest level since July 2010. This was driven in part by a contraction of new exports orders from 50.5 in April to 49 in May, likely reflecting supply-side disruptions caused by recent natural disasters in Japan. Coupled with an already high level of inventories, manufacturers continued to reduce stock levels (finished goods inventories fell to 48.5 in May), leading to a further slowdown of output growth which hit its lowest level in 10-months at 50.9 (vs. 51.8 in April). This pushed the difference between new orders and finished goods inventories to a weaker level compared to the previous quarter. But, cooling growth is not all bad news as it also helps to tame inflation. Both input prices and output prices' growth continued easing closer to their long-term averages after hitting peaking in 4Q 2010. It seems commodity price pressures may be starting to cool; China's input price index reached its lowest level since August 2010 at 60.1 (vs. 63.1 in April), a touch less than its long term average of 60.3. Output price growth cooled too, but by a lesser margin, to 54.6 in May from 55.2 in April (still higher than its long term average of 53.4). The divergence between input and output price deceleration suggest that demand conditions remain strong enough for manufacturers to pass on the burden of higher input prices. Following a faster-than-expected cool-down of April's IP data release, today's lower manufacturing PMI reading is likely to invite more concerns about China's hard landing. But we believe such worries are overplayed as: Price stability will continue to outweigh growth as the Beijing's top priority in the coming months, especially with headline CPI readings set to track higher until around mid-year. As such, current tightening measures must be kept in place for a while longer to manage inflationary expectations. We continue to expect more hikes in the coming months. Bottom line: IP growth is likely to slow in the months ahead but we see this as a moderation of rather than a slump in growth. It will not stop Beijing from pushing on with tightening measures to tame inflation in the coming months. |

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise