Securing and extending the digital economy with trust and user experience

Digital technologies are redefining a new global economy where digital identity, authentication and authorisation are essential pillars for FIs and governments.

When an Android-based malware affected a number of Singaporean consumers in 2015, it became painfully obvious that regional banks still have a lot to do to ensure the security of their mobile platforms. Banks need innovative methods to stay ahead of the threats plaguing the new digital economy, says Benjamin Mah, CEO and co-founder of secure mobile solutions specialist V-Key.

“The latest cybersecurity attacks are all focused on mobile,” Mah says. “The challenge facing digital banks is twofold: as they develop new services, they also have to develop new security measures that will secure those novel services. Old security frameworks won’t work for a bank in the new digital economy.”

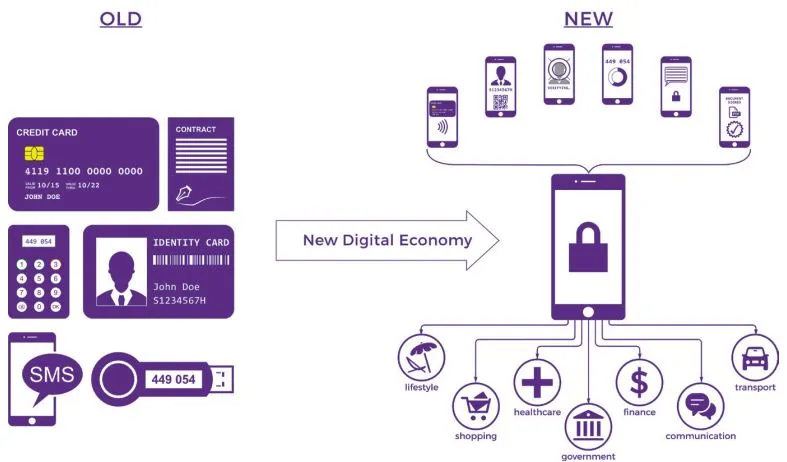

Transitioning into the new digital economy

Mah notes that currently, mobile banking is jeopardized by outdated technology. Although banks are splurging on app development, most financial institutions still rely on old and fundamentally insecure technologies, such as SMS One-Time-PINs. Even newer technologies, including hardware and the latest versions of Android and iOS, are under threat from sophisticated exploits, which can translate to thousands of dollars’ worth of fraud.

To address these security issues, Mah says, banks must realise a strategy for the new digital economy, and there are three areas which they should focus on. These are secure authentication, secure payments, and innovative channels of interfacing with the customer.

“Security is a threat to digital banking because a lack of it seriously hinders your ability to develop new features. You might develop a novel channel to handle mobile payments, but if you can’t secure it, there’s no point – no one will use it. V-Key enables a bank to develop and then execute a strategy for the new digital economy by enabling products and services that were previously not feasible,” Mah states.

Bulletproof technology

V-Key’s technology relies on a tried-and-tested security system—the smart chip – but with a unique twist. V-Key’s globally-patented V-OS platform incorporates the tamper-resistance of a smart chip, but is built entirely in software and is independent of the underlying hardware. Thus, V-OS is the world’s first virtual secure element. Being a virtual solution, app developers are freed from the security constraints imposed by device manufacturers. The V-OS platform ensures that hackers cannot obtain the secret cryptographic keys inside mobile apps, and is cheaper and more convenient to manage for both IT teams and end-users.

This rock-solid foundation that is simultaneously remarkably versatile allows V-Key to enable a number of use cases for the new digital economy that are at great risk of cyberattacks. First, it offers a secure data transmission solution that can be used for encrypted communications. Second, it offers a mobile soft token to replace expensive and inconvenient hardware tokens. Third, it has developed a implementation of MasterCard’s cloud-based payment standard, the first in Asia-Pacific. Fourth, it offers a number of mobile identity solutions designed to make online payment and authentication more convenient.

An example of how V-Key enables a strategy for the new digital economy is UOB’s Mighty app – a secure mobile wallet for all UOB debit and credit card holders. Customers with NFC Android phones can make transactions by tapping their phones against the merchants’ payment terminal and entering a PIN.

“V-OS is a platform, and security is an enabler in the same way that you consume electricity without knowing how it works. We are very excited for the future that we envision – a future without SMS OTPs or hardware tokens, without physical credit cards, and where we will have unlimited virtual SIMs on numerous devices powering a multitude of apps that we haven’t even dreamed of,” Mah says. “The old world that is rooted in hardware is passing away. Software is now the new hardware.”

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise