Infocomm sector satisfaction dips 1%

This marks the first decline for the sector since 2014.

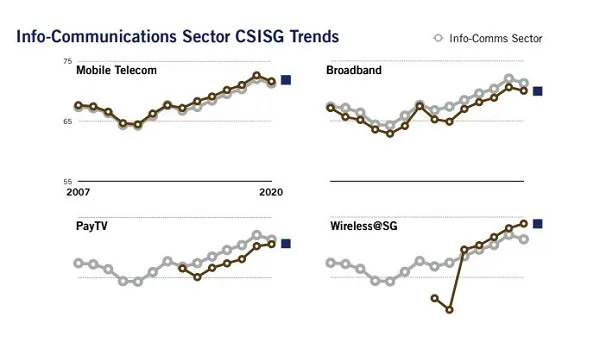

Customer satisfaction of subscribers in the infocommunications sector dipped by a marginal 1% YoY to 71.3 points on a 0 to 100 scale, according to the Singapore Management University’s (SMU) 2020 Customer Satisfaction Index of Singapore (CSISG).

This marks the first decline in the CSISG score for the sector since 2014.

Of the four constituent subsectors in the infocommunications sector, the mobile telecom subsector registered the biggest dip in customer satisfaction scores, falling 1.4% YoY to 71.7 points. This is followed by the broadband subsector which slid 0.8% to 70.1 points.

On the other hand, the Pay TV and the Wireless@SG subsectors recorded a 0.5% and 1.1% increase to score 70.6 and 73.9 points, respectively.

The report notes that the sector’s soft overall performance may be attributed to poorer performance in respondents’ perceived service quality. This is said to be seen in the mobile telco subsector, which saw its service quality score decline to 75.6 points this year from 78.1 points in 2019.

Further, the broadband subsector recorded substantially weaker levels of customer loyalty compared to the previous year, dropping by 5.4% to 68.9 points, compared to 72.8 points a year ago. This was coupled with a marked decrease in 2019 from 2.4 to 1.6 in terms of average number of telco services customers held.

Meanwhile, the Pay TV subsector saw an increase in customers subscribing to video streaming services such as Netflix to 40.7% compared to 11.5% in 2019. However, the report notes that this segment saw lower customer loyalty scores, with a notable 8.8% YoY decline.

ISE head of research and consulting Chen Yongchang notes that service-related attributes, such as providing prompt service, prioritising the best interest, and making a customer feel assured, were the most important drivers for mobile telco customers, suggesting that telcos need to renew their focus on these areas.

“The fall in customers’ average number of telco services held suggests challenges in the service providers’ ability to bundle services and should be an area of concern”, he remarked.

The study was conducted primarily between February and March and concluded before Singapore entered its circuit breaker phase.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise