Stocks

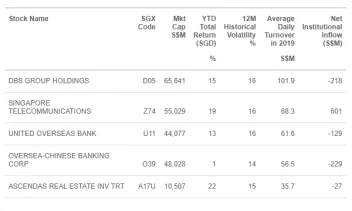

100 top traded stocks surpass STI benchmark

100 top traded stocks surpass STI benchmark

Individually, two-thirds of these stocks also outpaced the STI figure.

Yanlord to ditch UEL listing if it loses free float status

It currently holds 81% of UEL’s ordinary shares.

Adviser greenlights CITIC Envirotech's SGX-ST exit offer

It will voluntarily delist for 55 cents per share.

Securities' daily average grew 28% to $1.26b in November

Trading turnovers rose for the tech and REIT sectors.

Total returns of top 50 stocks hit 12% QTD

Seven firms are noted to have higher total returns compared to the best-performing trust.

Straits Times Index drops Golden Agri-Resources

Mapletree Logistics Trust will replace the agribusiness firm.

Ascendas REIT issues 498 million rights units under $1.31b programme

This brings the total number of issued units to 3.61 billion.

Daily Markets Briefing: STI down 0.36%

CapitaLand led the gains amongst top active stocks with a 0.3% climb.

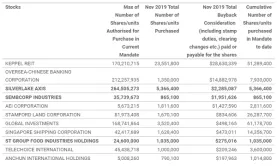

Buyback value soars threefold to $52m in November

Keppel REIT led the pack at $28.63m or 51.29 million shares.

Share price of semiconductor stocks surged 50% in November

Emergence of new technologies buoyed demand for advanced chips.

Small-cap stocks to gain ground over privatisation surge

Privatisations rose from 14 in 2018 to 34 in 2019.

SGX RegCo eyes scrapping minimum trading price rule

It will stop adding companies to the MTP watch-list for the meantime.

2 World Bank Philippines Catastrophe Bonds get listed on SGX

The cat bonds will fund $307m of protection against earthquakes in the Philippines.

SGX launches variable rates for securities borrowing and lending programme

Borrowing rates for index stocks, REITs, and business trusts will be changed from 6% to 0.5% per annum.

Daily Markets Briefing: STI down 0.28%

CapitaLand led the gains amongst top active stocks with a 0.3% climb.

Keppel Capital to buy 50% interest in Pierfront Capital Fund Management

It will act as the investment manager of their combined funds.

Temasek prices 12-year and 30-year euro bonds at 0.5% and 1.25%

Both issuances were oversubscribed.

Advertise

Advertise

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)