SGX daily average value up 12% to $1.2b in August

Market turnover value for ETF climbed 23% MoM to $231m.

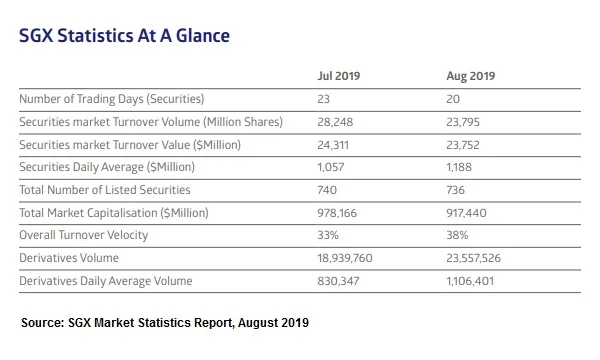

Securities daily average value (SDAV) in the Singapore equities market recovered after a weak July reading to bounce back 12% MoM to $1.2b in August despite a 5.9% MoM decline in the benchmark Straits Times Index (STI), SGX announced.

Also read: SGX net profit up 7.7% to 11-year high of $391.1m in 2019

Market turnover value for exchange traded funds (ETF) climbed 23% MoM to $231m during the same period. SGX noted that this aligns with the growing preference amongst investors for passive investing strategies.

Meanwhile, market turnover value of Daily Leverage Certificates (DLC) rose 52% MoM to $114m as active investors looked to capture short-term opportunities.

Amongst bond markets, the green, social and sustainability bond market reportedly continued to gain momentum due to Korean issuers. Notably, Shinhan Financial Group and Lotte Property & Development listed sustainability bonds on SGX, raising a combined $1.1b (US$800m).

In the foreign exchange (FX) markets, SGX INR/USD Futures trading volumes jumped 61% YoY to an all-time high 1.6 million contracts, amidst headwinds for the Indian rupee, SGX reported. The renminbi had weakened with the lack of progress over trade talks between Washington and Beijing, falling below 7 against the dollar. Meanwhile, SGX USD/CNH Futures volumes climbed 50% YoY to 965,241 contracts, setting two record trading days during the month. Total FX futures volumes on SGX–Asia’s biggest exchange for currency derivatives– soared 59% YoY to 2.62 million contracts, the report added.

Overall, SGX observed that volatility returned to equity markets in August following the US Federal Reserve’s decision in the previous month to cut interest rates, the first reduction since the 2008 global financial crisis.

Against the backdrop of lower interest rates, global REIT indices generated gains amidst lower interest rates, with Singapore no exception. Two of the three best-performing constituents of the FTSE ST Mid Cap Index over the first eight months of 2019 have been rewarded with key index inclusion starting 23 September: Mapletree Commercial Trust will join the STI, whilst Frasers Centrepoint Trust will be part of the FTSE EPRA/NAREIT Global Real Estate Index Series (Global Developed Index).

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise