Singapore-based firms top private equity deals in Southeast Asia: EY

Private equity activity across the region went up 31% to U$586m last quarter.

Singapore-based firms CapitaLand Investment (CLI) and CBC Group made the two biggest private equity-backed investments in Southeast Asia in the first quarter, according to EY.

In its Quarterly Private Equity Update, the global consultancy firm said the biggest PE-backed deal in the region last quarter was the acquisition of Hotel G in Singapore by a joint venture between CLI’s Ascott subsidiary and CapitaLand Wellness Fund worth US$180m.

CLI and Thai developer partner Pruksa Holding set up CapitaLand Wellness Fund last year to invest across Southeast Asia's wellness and healthcare-related real estate assets, with a target equity size of S$500m.

Taking the second biggest deal was CBC, a healthcare-dedicated asset management firm based in the city-state which acquired a portion of Korean pharmaceutical firm Celltrion Group’s primary care business rights in Asia Pacific in a deal valued at US$163m.

For the biggest PE-backed exits last quarter, the sale of Hotel G ranked first having sold by Hong Kong-based Gaw Capital Partners.

Singapore-based business services firm In.Corp Global placed third after it was sold by global private equity firm TA Associates to Hillhouse Investment in February for an undisclosed sum.

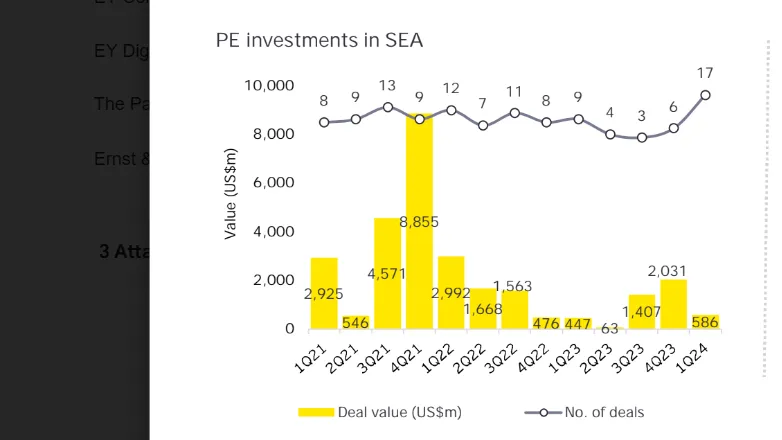

Across Southeast Asia, data from EY showed the total volume of PE-backed deals went up 89% year-on-year with 17 transactions in the first quarter.

These transactions amounted to US$586m overall, up 31% from the year prior, with real estate transactions accounting for a third of the tally. This is followed by deals in the healthcare and financial services sectors which made up half of the total.

“For the rest of 2024, the emphasis on bespoke transactions and unique deal structures, such as secondary deals, minority purchases, convertibles or structured investments, platform acquisitions, are expected to intensify,” said Luke Pais, EY Asia-Pacific Private Equity Leader. “PE funds are prepared to hold for longer and will continue to drive value creation in their portfolio through operational improvements and bolt-on investments.”

“Opportunities across private credit space will grow, especially in mid-market where bespoke financing solutions are more attractive,” Pais added.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise