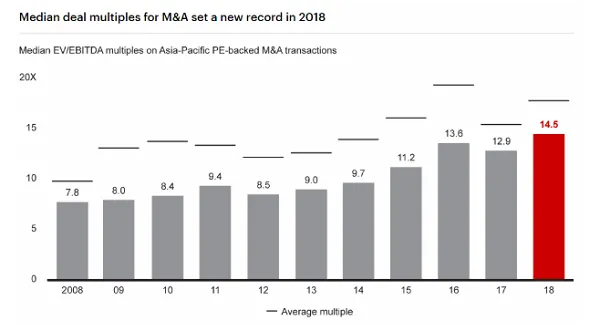

Median deal multiples for PE-backed M&As set a new record in 2018: report

Deals focused on restructuring, carve-outs and turnarounds rose in value to more than triple the previous five-year average.

The median earnings before interest, tax, depreciation and amortisation (EBITDA) multiples on Asia-Pacific private-equity (PE)-backed mergers and acquisitions (M&A) transactions in 2018 set a new high after rising to 14.5 from 2017’s 12.9, according to Bain & Company’s 2019 Asia-Pacific Private Equity report

Although growth equity deals captured the headlines, deals that focused on restructuring, carve-outs and turnarounds rose in value to more than triple the previous five-year average, led primarily by South Korea.

According to the report, transactions with two or more investors reached a new high in 2018, helping PE firms tap into ever-larger deals. The number of deals involving multiple investors rose to 71%, compared with an average 56% over the past five years, and a growing number include five or more investors.

“In PE transactions worth $500m or more, almost 80% involved multiple investors,” the report’s authors added. “The average number of investors per deal in the Asia-Pacific region in 2018 was 3.3, up from 1.7 in 2013.”

Meanwhile, a few trends were observed to have driven private equity investment across the region, including greater overall acceptance of private equity and a shortfall of managers able to help companies achieve the next phase of growth. “Company owners increasingly recognize that global general partners (GPs) bring a network and capabilities that local and regional corporate investors can’t match,” the authors explained.

Private equity investors are reportedly choosing from a broader pool of companies across the region, thanks in part to secondary deals, or exits where the sale is to another PE owner, the report noted. Secondary deals represented 10% of total deal value in 2018 and are likely to continue rising. However, this is still well below the levels seen in the US or in Europe, which averaged, respectively, 17% and 53% of the market value in the past five years.

Moreover, the report highlighted that most funds have a significant overhang of capital, enabling them to make investments. Committed but unspent capital, also known as dry powder, set a new record in APAC after rising to $317b by end-2018, or three years of future supply at the current pace of investment, from $267 billion in 2017.

“Sustained past fund-raising activity contributed to the surge, along with Preqin’s improved coverage of China funds,” the authors added.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise