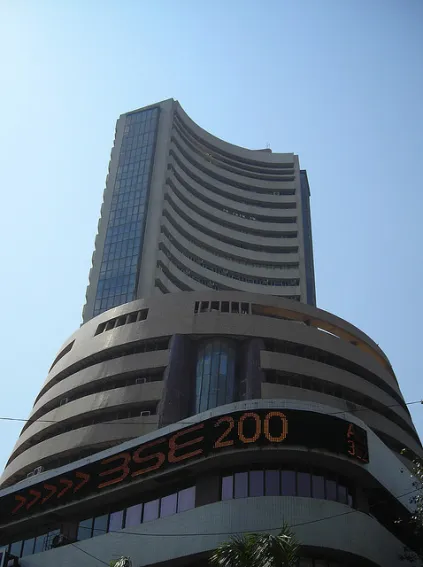

Are you ready for an Indian bull run?

Morgan Stanley thinks the Indian market is already getting pumped and primed for a surge.

But calling it guaranteed would be foolish. The Indian market might be displaying traditional bull market indicators like favorable liquidity and attractive valuations, but lingering doubts remain in fundamentals and other vital trends.

Here's more from Morgan Stanley:

Narrow indices are past their 200DMA for the first time since February 2011. Sector rotation has hit a 15-month high. Cyclicals are back and the so-called defensives have underperformed. These are tell-tale signs of a new bull market. Is this a case of the market telling us where the fundamentals are heading or is this a head fake? Simply put, are we in a new bull market?

New bull markets are started by favorable liquidity conditions and attractive valuations. At the end of December, both ingredients fell into place. Bull markets make progress as fundamentals improve. Fundamentals can come in various forms such as technology changes and favorable demographics, but ultimately all these changes imply upward revision in growth forecasts. Not surprisingly, fundamentals remain fuzzy. The market continues to have support from skeptical positioning and low expectations. We expect upward progress, although the pace of the recent move may induce volatility.

If this is indeed a new bull market, the preceding bear market at 60 weeks and -26% return will prove to be the shortest and shallowest in 20 years – a far cry from the average 50% fall seen in previous bear markets. Valuations are around 30% higher than what they were at the end of the previous three bear markets. This could create doubts about this being the start of a new bull market.

What do we need to be sure that this sustains as a new bull market? The key difference between the 2003-08 period and now is that global growth is no longer supportive. To that extent, it needs an extra policy push to pull India’s growth rate back to trend.

Corporates are suffering from poor profitability --inflation needs to remain moderate for that to improve. That will also help rates to fall. The key risks remain Europe and oil. India needs time to adjust its macro to absorb risks from Europe and oil.

If these risks do not unfold in say the coming six months, the second half of 2012 may prove to be even stronger for equities. None of these are differentiated insights, but the good news is very few believe these events will happen, and markets sometimes favor climbing walls of worries.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise