Companies with data centre exposure hit average total return of 31.6% YTD

Keppel DC REIT leads the pack with returns of 54%.

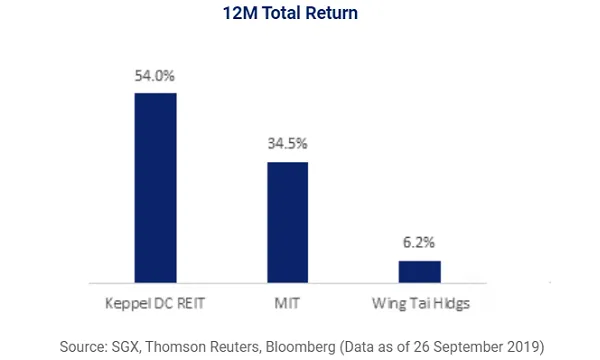

The three stocks that have been pursuing data centre (DC) growth recorded an average total return of 31.6% over the past twelve months YTD and an annualised total return of 18% over the past three years, which is said to have outpaced the STI over the two periods, according to an SGX report.

The 12-month figure is led by Keppel DC REIT with returns hitting at 54%, followed by Mapletree Industrial Trust (MIT) at 34.5% and Wing Tai Holdings at 6.2%. These three have a combined market cap of $9.2b and averaged $17m a day in trading turnover over the first eight months of 2019. During the eight-month period, all three stocks saw combined net institutional inflows close to $40m.

These three have all announced acquisitions to expand their data centre assets recently. Keppel DC REIT revealed two property acquisitions (KDC SGP 4 and 1-Net North Data Centre) that are expected to bring the REIT’s assets under management growth by 30.7% to $2.58b, comprising 17 DCs.

MIT has proposed to acquire 13 DCs in North America through a 50:50 joint venture with Mapletree Investments Pte Ltd (MIPL) for $1.89b (US$1.37b). This follows its prior acquisitions of 14 US DCs for $1.04b (US$750m) last December 2017 through a 40:60 joint venture with MIPL.

Lastly, Wing Tai Holdings also announced that WT DC Trust II, a wholly-owned subsidiary of the firm, entered a sale and purchase agreement with Evergreen Nominees (Victoria) to buy a freehold DC located within Tally Ho Business Park and wholly-leased to a major NYSE-listed IT services company for $47.68m (A$51m).

In a Cushman & Wakefield report, Singapore is ranked as the most competitive data centre market in Asia Pacific (APAC) for the third straight year, beating Hong Kong.

Also read: Data centre operators turn West amidst Tai Seng space crunch

Globally, the island nation jumped four places to clinch the third spot behind Iceland and Norway and ahead of major economies such as the United States (7th), Hong Kong (9th), United Kingdom (10th), and Germany (17th).

Singapore has attracted a number of tech companies to set up data centres, with the most notable being Facebook with its $1.39b data centre. Other companies include Equinix, Digital Realty, and ST Telemedia; whilst at least two other operators, including Google, have successfully tendered for land plots from Jurong Town Corporation to build data centres.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise