Beverage company director busted for tax fraud

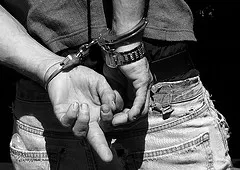

Suharry Bin Abdullah should stay sober in the next 4 months as he serves his sentence in jail.

According to a release by the Inland Revenue Authority of Singapore, Suharry Bin Abdullah, the director of a beverage company, Republic Beverages Company Private Limited was sentenced to 4 months’ jail and ordered to pay a penalty of $140,023.59 for creating false GST entries and fictitious invoices to defraud the Comptroller of GST. RBC was fined $40,000 and ordered to pay the same amount of penalty.

False GST claims and fictitious invoices

GST-registered businesses can offset the GST they pay on their purchases (input tax) against the GST they collect from sales (output tax), and pay the net difference to IRAS. If a business incurs more GST on purchases (input tax) than it collects from sales (output tax), it can claim a refund of the difference from IRAS.

Started in 2006, RBC is a company that engages in supply and distribution of beverages. Suharry made false entries in RBC’s GST returns from March 2008 to August 2008, resulting in net GST refund claims which he was not entitled to. The total amount of false GST claims was $32,158.98. In addition, Suharry had also created 6 fictitious purchase invoices when IRAS requested for supporting documents. IRAS also uncovered that Suharry had forged the 6 suppliers’ invoices in his attempt to mislead IRAS into thinking his GST refund claims were genuine. The total amount of GST involved for the forged invoices is $20,394.64.

Claiming input tax on fictitious purchases is an offence. Offenders face a penalty of up to 3 times of the amount of tax undercharged and/or imprisonment up to 7 years.

Suharry and RBC faced 8 charges each. Suharry pleaded guilty to 10 of the charges. The remaining 6 charges were taken into consideration for sentencing. Suharry was sentenced to 4 months imprisonment and ordered to pay a penalty of $140,023.59, which is 3 times the amount of tax undercharged.

Voluntary Disclosure Programme

IRAS takes a serious view of GST-registered businesses that wilfully make false claims for GST refunds or under-charge GST on sales. Tax evasion is a criminal offence punishable under the law and the Court imposes severe penalties for such offences. Businesses or individuals should disclose any past tax evasion immediately. IRAS will treat such disclosure as a mitigating factor when considering the penal charges.

IRAS is also aware that some businesses and individuals could be negligent or unaware of their tax obligations, resulting in mistakes. IRAS views such mistakes differently from tax evasion. In the spirit of encouraging voluntary compliance, IRAS imposes lower penalties for such mistakes disclosed voluntarily by taxpayers.

Photo credit: Stuart Matthews

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise