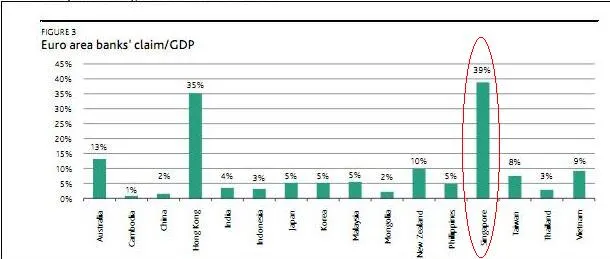

Singapore amongst exposed to risk of deterioration in the Euro area

Singapore exhibits highest reliance on Euro banks with more than a third or 39% of its GDP are Euro banks' claims.

The figure means that Singapore's relatively high overall loan to deposit ratios may indicate the country's poor capacity to fill the possible vacuum in credits due to the retreat of euro area banks, says Moody's

In a recent report, Moody’s analyzed and classified 16 banking systems in Asia Pacific into three categories, in terms of their exposure to extreme distress in the euro area: More Exposed, Exposed, and Less Exposed. The classification is based on assessment of five main areas: (1) a banking system’s dependence on external funding; (2) the significance of euro area banks in individual banking systems; (3) economic dependence on exports; (4) the overall challenges faced by the banking system; and (5) government’s or central bank’s capacity to support banks, if needed.

Moody’s conclude, based on these factors, that the banking systems in Australia, New Zealand, Korea and Vietnam are the ones most exposed to a fallout from the euro area. Meanwhile, Moody’s classify ten banking systems to the “Exposed” category: Cambodia, China, Hong Kong, India, Japan, Malaysia, Mongolia, Singapore, Taiwan, and Thailand. Those in the “Less Exposed” category are Indonesia and Philippines.

According to Moody’s, Singapore, along with Hong Kong are intrinsically exposed to potential hiccups in the international capital markets as a result of an escalating euro area crisis.

“In both economies, domestic activities are largely funded by sticky domestic deposits, yet money market rates have been rising along with global risk aversion, a development that has underpinned gradual rises in retail lending rates,” says Moody’s.

“ Both economies also serve as major regional trade hubs, exposing them to a Europe-led slowdown in regional trade flows, and any weakening in Asia’s corporate sector as a result,” it adds.

According to Moody’s, Singapore is highly exposed to Euro area banks' influence on banking system and country's economic dependence on Exports. It has meanwhile moderate exposure in terms of dependence on external funding and limitations on government to provide liquidity.

“For Singaporean banks, their foreign currency loan-to-deposit ratios of around 100% partly reflect their expanding USD lending, amid the deleveraging of euro area banks. As a result, their reliance on wholesale USD funds has increased, which makes their funding more exposed to adverse developments in the capital market,” says Moody’s

According to Moody’s, Singaporean banks have relied on multiple channels to fill their USD funding gap, including swapping SGD with USD, and outright USD borrowing from the interbank market or debt issuance. In the event that an escalation in the euro area crisis may reduce liquidity in the direct funding market, Moody’s expect swaps, especially those performed with the Monetary Authority of Singapore, to be the main channel of USD funds for Singaporean banks

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise