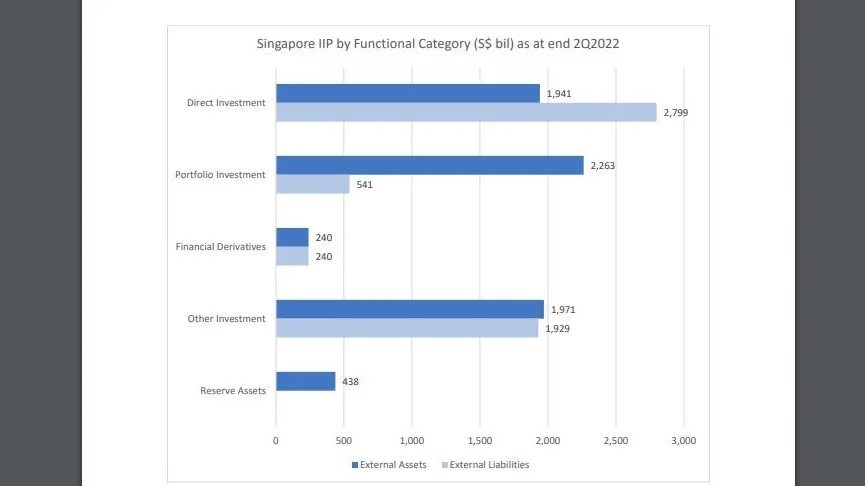

Chart of the day: Porfolio investments records highest external assets in IIP in Q2

Meanwhile, direct investments achieve the highest in external liabilities for the quarter.

This chart from the Department of Statistics shows the external assets and liabilities in Singapore’s economy in the second quarter revealing the country’s International Investment Position (IIP).

Portfolio investment record the highest external assets in IIP for Q2 at $2.263t with external assets only at $531b. The portfolio investment category recorded a net asset position of $1.722t

ALSO READ: CapitaLand Ascendas REIT to transform San Diego office property into a life science building

Direct investment category, meanwhile, showed the highest external liabilities at $2.799t with external liabilities at $1.941t, registering a net liability position of $859b.

Other investments recorded a total net asset position of $42b. Reserve assets stood at $438b as at end of Q2 2022.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise