Japan's inflation seen bottoming out

It should rise to 1.0% by end-2016.

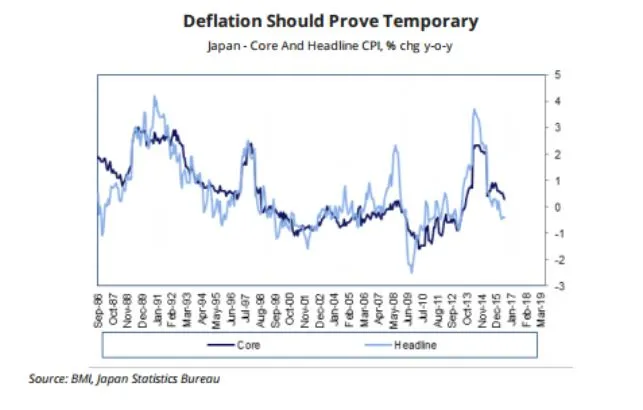

Japan’s deflation should prove temporary only, says BMI Research. The research firm, a subsidiary by Fitch rating said that the inflation is bottoming out and should rise to 1.0% by the end of the year and 2.2% by end-2017.

As a result, BMI also believes that the BoJ will likely be forced to increase its stimulus measures in order to keep bond yields from rising aggressively, which should begin to feed through to a weaker yen and higher inflation.

“While the country's large income account surplus is a major factor keeping inflation subdued, a declining national savings rate will ultimately undermine this surplus,” it said in a report.

Here’s more from BMI:

The Bank of Japan (BoJ) decided to broadly maintain its monetary policy stance at its September 21 meeting, but indicated that further interest rate cuts and asset purchases are on the horizon. The BoJ also noted that it will let inflation overshoot the current 2.0% target, which put to rest any fears that it would ease up on its 2.0% target amid continued failure to reach it. Talk of allowing inflation to overshoot 2.0% is interesting given that the current headline CPI figure is -0.4% and core CPI is 0.3% (as of July).

However, we believe that inflation is bottoming out and should rise to 1.0% by the end of the year and 2.2% by end-2017. The BoJ will likely be forced to increase its stimulus measures in order to keep bond yields from rising aggressively, which should begin to feed through to a weaker yen and higher inflation. Additionally, rising oil prices will provide an additional tailwind to inflation.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise