RHB

A financial services group based in Malaysia

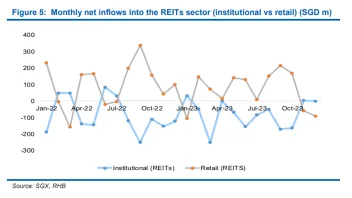

S-REITs face better year ahead amid rate cuts, improving economy

S-REITs face better year ahead amid rate cuts, improving economy

The next major S-REIT rally is seen happening in Q2.

Sustained growth seen for SGX-listed F&B operators, says expert

Coffee chain Kimly is RHB’s top pick.

Singapore’s non-oil domestic exports face bumpy recovery in H1: experts

Outlook for the second half looks rosy.

Analyst sees sluggish year ahead for real estate market

CDL remains RHB’s top pick this year.

STI profit growth to settle at 4.5% in 2024: RHB

Bank earnings seen moderating.

Signs of a broader recovery in manufacturing could emerge in mid-2024: expert

An expert said manufacturing activity has likely bottomed following the 7.4% YoY jump in output in October.

4 investment opportunities stemming from Singapore's ageing population

Singapore was dubbed as the country with the biggest silver economy potential.

Is Singapore on the path towards stronger IP annual growth?

In September, manufacturing output grew 10.7% MoM.

4 key investment themes for 4Q23 unveiled

Experts are cautious about their near-term outlook for Singapore equities.

Electronics cycle shows tentative signs of bottoming – expert

In September, electronics NODX saw a narrower contraction of 11.6 YoY.

Will MAS finally ease its monetary policy in 2024?

Experts say the central bank has seen the end of its tightening cycle.

3 catalysts that will accelerate Singapore's economic growth in 2024

Analysts expect GDP to grow by 3.0% next year.

Singapore food manufacturers in for a treat as consumption recovers in 2024

Many would benefit from recovering consumption across Thailand, Vietnam, and Indonesia.

3 reasons why MAS to keep policy settings ‘unchanged’

MAS will hold its monetary policy meeting no later than 13 October.

Private residential prices to fall until 1Q24: analyst

In 3Q23, prices remained broadly flat, increasing marginally by 0.5% QoQ.

August contraction a ‘blip,’ IP momentum to still improve in 4Q – expert

RHB cited 2 factors for the deeper-than-expected manufacturing output decline in August.

MAS unlikely to change monetary policy in October – experts

There is, however, a 40% chance that it will reduce the slope of the S$NEER band slightly.

Advertise

Advertise

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)