Commercial Property

Will Raffles Education sell off more land?

Will Raffles Education sell off more land?

Chances are high that its recent sale of campus land is only the beginning of an unloading spree, says DBS.

Raffles Education signs accord with Langfang Fenghe for sale of Hebei, China properties

A Raffles Education subsidiary entered into an overall agreement with Langfang Fenghe International Golf Club.

Singaporean REITS rule in cross-border acquistions

S-REITS proved attractive to overseas investors but not to domestic ones which comprise only a third of the total shares as of Q411.

Second Chance Properties appoints Geetha Padmanabhan as Director

She will act as adviser t0 the Company on finance and accounting matters.

Second Chance Properties' Executive Director resigns

Mohamad Ferus Bin Abu Bakar abandoned post for personal reasons.

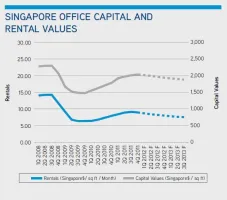

Chart of the Day: Office rents dip by 1.6% in 4Q2011

The average monthly gross rents for CBD Grade A office space fell to SGD8.93psf, the first time since the market bottomed in 4Q2009.

Singapore office rents stay competitive against Hong Kong and Tokyo

Singapore has been the third most expensive office location in Asia since 2009 at US$82.42 per sq ft per year in 4Q 2011.

UOL to hold prices at the Archipelago

Prices will be firm at ~S$1,000 psf in order not to undercut previous buyers.

Business parks and hi-tech rents slowdown in Q4 2011

Rents in Business and Science park as well as hi-tech space peaked in Q3 2011 at $3.85 psf/mo and $2.85 psf/mo, respectively but stayed firm through...

UOL Group's Director resigns

James Koh Cher Siang quitted the post due to pave way to board renewal.

UOL’s profit jumps 32% to $728m in 2011

As revenue for the group’s hotel operations surged on the back of strong tourist arrivals last year.

2012 will be the ‘inflection point’ for Capitamalls Asia, says spokesperson

Find out what the spokesperson exactly means.

OUE’s net profit plunges 57% to S$337.4m in 2011

As investment properties held by the group’s associate, OUB Centre Limited, did poorly last year.

CapitaMalls Asia's latest spending spree revealed

CMA will be investing a total of S$217.4m for its latest acquisitions.

Singapore Land rentals and sales to remain in a tailspin

Both major revenue streams are facing difficulties in 2012 that will be hard to surmount.

Wheelock Properties’ revenue plummets 56% to $56m in 4Q11

As Scotts Square generated lower than expected revenue last year.

Singapore Land’s net profit plunges 51% to $330.7m in 2011

As gross rental income from investment properties dropped by $8.6 million last year.

Advertise

Advertise

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)