Singapore commercial real estate investments up 14% in Q1

APAC commercial property investments are up 13% YoY.

Commercial real estate transactions in Singapore rose 14% year-on-year to US$2.2b in the first quarter as trades of retail and hospitality assets picked up, according to JLL’s latest Capital Tracker.

The city-state saw investments in the retail segment increase significantly last quarter due to the sector’s favourable leasing market and positive yield spread over funding costs, recording two major deals valued at over US$250b, including the sale of The Seletear Mall.

JLL said the islandwide retail vacancy remains low while capital values continued to rise by 0.6% YoY for prime and suburban malls, largely due to the limited supply of quality retail assets.

Commercial property investments also rose in Singapore, albeit at a softer rate of 14% YoY compared to the two other markets, according to the property agency. The city-state booked US$2.2b worth of transactions last quarter, driven by strong demand in the retail sector.

Hospitality also contributed to the strong showing last quarter as the sector drew in global investors who are looking to ride the robust tourism rebound. Private equity players have been particularly active in the sector according to the property agency.

“Singapore’s suburban retail sector continues to be highly sought after by global and domestic capital seeking exposure in the tightly held retail investment market. The compelling resilience of the retail sector in addition to the attractive returns profile underpins the demand of capital partnering retail experts to access the market,” said Ting Lim, JLL’s head of capital markets for Singapore.

JLL expects investors to mainly focus capital on the retail, hospitality and logistics sectors for the rest of the year.

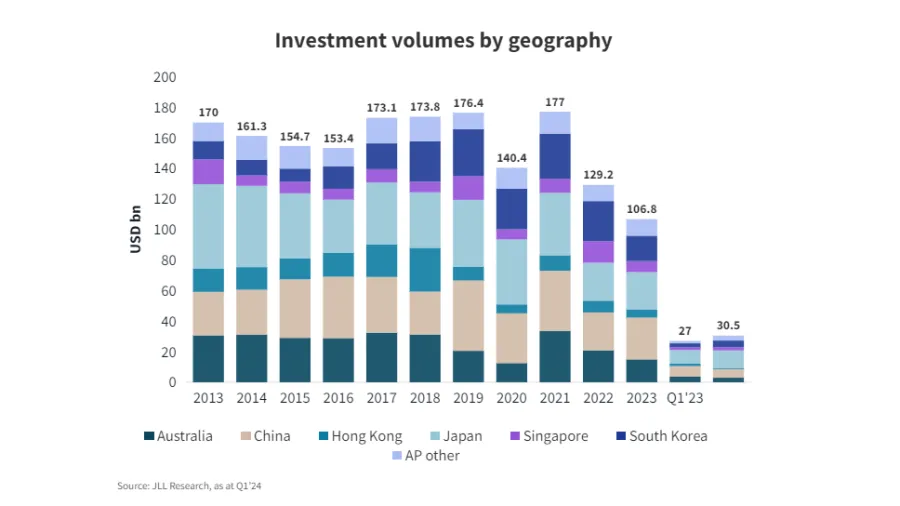

Across the region, trades of commercial assets in Asia Pacific rose 13% YoY to US$30.5b in the first quarter, snapping seven straight quarters of decline.

Nearly half of the total or US$11.5b worth of transactions were recorded in Japan, up 29% YoY, with domestic investors shopping for core properties while foreign investors turned to opportunistic buys.

South Korea followed closely behind with a 73% surge in commercial real estate deals worth US$4.3b, largely thanks to the country’s strong office market that continues to display stable fundamentals, tight vacancy and high leasing demand.

“Uncertainty surrounding interest rates continues to influence investment activity in Asia Pacific, but we’ve seen a partial rebound and recovery in 2024,” said Pamela Ambler, Head of Investor Intelligence for APAC at the property agency.

“Looking ahead, we expect further investment activity as repricing sets new benchmarks for trade, and investors adapt their portfolios and strategies to the current rate environment,” Ambler added.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise