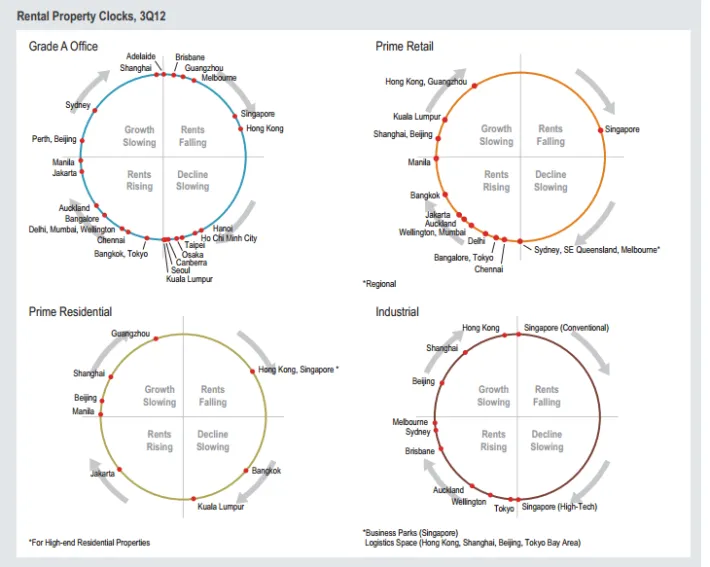

Property rental clocks: Here's how office rental prices in Asia have gone so far

Singapore and Hong Kong present almost similar stories.

Here's from Jones Lang La Salle:

During 3Q12, office supply additions were largely unchanged y-o-y at 1.6 million sqm, with the majority of the supply added in China and India.

Aggregate net absorption fell by about 30% y-o-y to around 1.0 million sqm, with China and India accounting for 70% of the total.

Expansion demand remained subdued across the region on the back of corporate caution and slower economic growth. More returning space emerged in Hong Kong and Singapore due to financial sector contraction.

Expansion by MNCs slowed in both China and India. Moderate net take-up in North Asia and emerging SEA was largely driven by relocations and consolidations, while expansion demand remained strong in Jakarta.

Most of the Australian CBD markets recorded weak or negative net absorption, largely due to more sublease space emerging.

Modest rental movements were witnessed across Asia Pacific’s major markets in 3Q12, with either smaller rental growth than 2Q (generally less than 3% q-o-q) or modest declines. Jakarta (8.1% q-o-q) and Beijing (5.1%) continued to record the largest q-o-q increases due to a lack of quality space.

Tokyo saw a moderate increase (2.3%) for the second straight quarter. Average rents in India were flat or grew marginally. Rental declines remained moderate in Hong Kong (2.2%) and Singapore (1.2%) as any contraction in space requirements in both cities has been modest.

Rents fell further in a few other Asian markets (e.g., Guangzhou, Ho Chi Minh City) due to weak tenant demand or new supply. Effective rents fell in most Australian cities, by up to 3%.

Last year was a record for net absorption across Asia Pacific. We expect this year to be 25 to 30% lower, mainly as a result of slower economic growth and corporate hiring, as well as fewer supply additions in some markets.

Over the short term, rental growth is likely to be limited in most markets, while Hong Kong, Singapore and a few Australian cities should see further moderate declines. Single digit rental growth is generally expected in 2013 with rents in Hong Kong and Singapore starting to recover in 2H13 and the strongest growth likely to be seen in markets such as Beijing and Jakarta.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise