Low Q2 shophouse transactions not reflective of market interest

In Q2, sales fell 30.4% QoQ and 66.0% YoY.

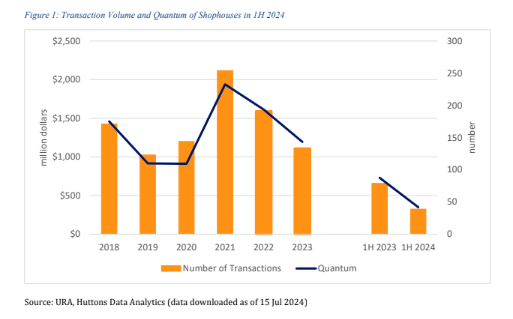

The shophouse market reported a 30.4% QoQ and 66.0% YoY decline in sales in Q2 2024, with only 16 transactions.

The total value of Q2 transactions was $163.7m, lower than the $185m record in Q1 2024 and the $432.3m in Q2 2023.

Half of the shophouse transactions took place in the investor-favored District 8.

Buyers paid between $4.3m to $5.3m for shophouses in the district.

Huttons underscored that the low transaction volume in 2Q 2024 “is not an accurate representation of the level of

interest in shophouses.”

“There was strong interest in the shophouses linked to the money

laundering case put up for sale. Some of these shophouses are in the process of completion,” Huttons said.

Huttons expects the completion of money laundering case shophouses to boost H2 2024 sales volume and value.

“Whilst volume may pick up in H2 2024, the shophouse market is expected to be subdued in 2024 compared to the previous year. In 2024, the transaction volume and quantum of shophouses is forecasted to be 30% to 40% lower than 2023,” Huttons added.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise