Investors to stay cautious navigating Singapore’s property market in 2024

Investment volume is seen rising 15% this year.

Investors are likely to stay cautious navigating Singapore’s real estate market this year in light of prolonged market uncertainties and moderate growth in prices and rents across all sectors, CBRE said in its latest market outlook.

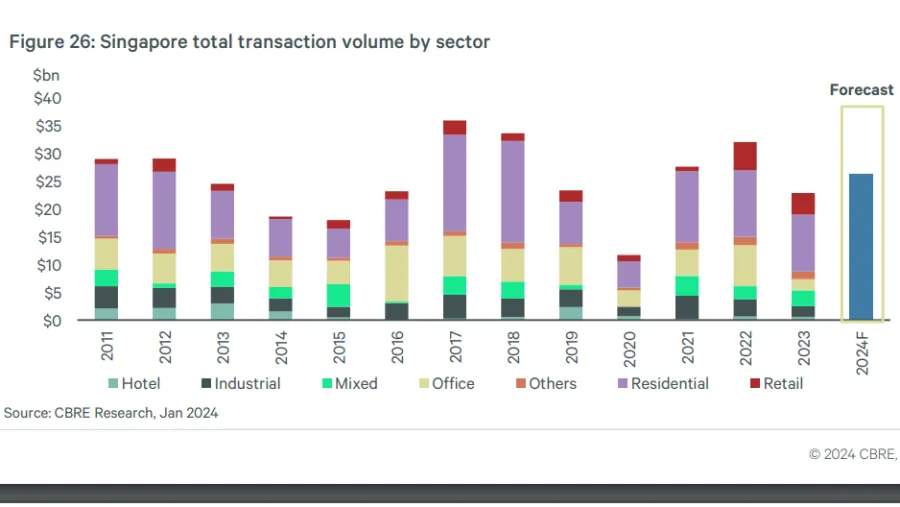

The property agency estimated overall real estate investments in the city-state to rise 15% this year from last year’s $22.8b tally, recovering from the 29% year-on-year drop in 2023 but still lower than the $30b of investments logged in 2022.

Many investors remained cautious last year due to the economic headwinds at home and ongoing geopolitical risks abroad, coupled with a high-interest rate environment, according to CBRE managing director of Singapore advisory services, Moray Armstrong.

Despite the gloomy picture, he said brighter prospects await the property market particularly in the second half of the year, once borrowing costs ease from their current highs and the domestic economy improves.

“A more significant recovery in investment activity could play out in H2 2024 if interest rates taper off and stabilise at levels that provide investors with confidence of positive carries in their acquisitions,” the property agency said in its report.

CBRE Head of Research Tricia Song estimated core CBD Grade A office rents to rise slightly faster at 2% to 3% in 2024 from the 1.7% increase in 2023, fueled by strong demand for high-quality buildings in the city centre.

Tempering office rental growth is the new supply entering the market this year, led by IOI Central Boulevard Towers, Labrador Tower and Paya Lebar Green.

In the retail sector, Song also expects a modest rental growth of 3% to 4% this year on the back of a robust tourism rebound and an anticipated supply crunch in the coming years.

The once red-hot private residential market is also seen cooling down this year with prices estimated to increase by just 3% to 4% and home sales to range from 7,000 to 8,000 units and below the five-year average annual home sales of 9,288 units.

Prime logistics rental growth is seen moderating to 6% this year as well ahead of the expected supply surge in the coming years.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise