Industrial leasing volume decline 7.7% in Q1 over weak global trade demand

This is the lowest since 2020.

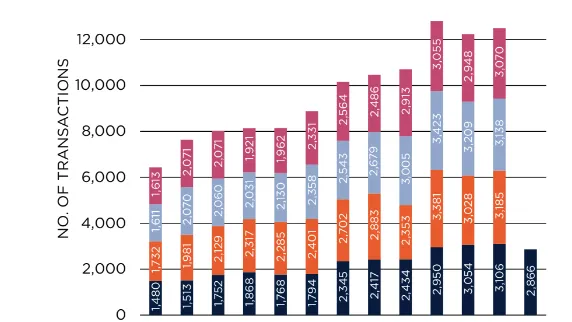

Singapore’s industrial leasing slowed down in the first quarter of 2024, recording a decline of 7.7% to 2,866 tenancies versus the previous year, the latest data from Savills showed.

The lacklustre performance was associated with weak global trade demand. Demand for factory space softened as some firms could have postponed their expansion as part of cost-saving strategies, the report said.

Leasing volume fell across all segments, especially for single-user factory, which declined 11.3% from last year.

In terms of vacancy, this reached a new record high of 12.2% in the single-user factory segment in Q1, while it was flat for multiple-user factories at 9.5%. Level for warehouses rose to 8.9% as supply outweighed, Savills said.

Quarter-on-quarter (QoQ), Savills said industrial rents continued growth, increasing by 1.7% in Q1.

Rents for single-user factory and warehouse segments grew 2.1% and 2%, respectively, whilst those for multiple-user factories rose 1.3% QoQ.

Savills expects rents for some segments to rise this year despite growing vacancy. This is expected to be led by prime warehouse and logistics segments.

Alan Cheong, executive director, research and consultancy at Savills Singapore, said the rise in rent despite rising vacancy rates can be explained by “tenancy of last resort.”

“SMEs, be it those in the traditional industries or software developers shift down from larger and more expensive industrial building types to lower cost ones. Also, some SMEs who require small storage space but cannot find those sizes in warehouses - since their lettable area offered is often much larger - would resort to storing it in factories,” he explained.

“Therefore, factory spaces that rent for $1.90 psf per month have now become the backstop for the SMEs who are still not giving up the fight in this difficult environment,” he added.

If business conditions do not improve, Cheong said rents may have to reflect this.

Still, the rental growth is projected to slow down because an estimated 3.7 million square feet (sq.ft) net lettable area (NLA) is expected this year. This is 48% higher than the average of 2.5 million sq ft (NLA) in the last four years.

“Upcoming supply for single-user factory space is also expecting a surge to 10.7 million sq ft (NLA) this year, compared with the four-year average of 4.5 million sq ft (NLA). The increase in supply is likely to put pressure on the vacancy rate and hinder rental growth,” Savills added.

MORE LIKE THIS: Singapore industrial rents, prices seen easing this year

For now, Savills maintained its rental forecast for multiple-user factories at 0% year-on-year while those for warehouses are expected to expand between 0% to 3%.

![SBR 5 Lorem Ipsum News 2 [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_3.png.webp?itok=M3Hf-9XR)

![SBR 4 Lorem Ipsum [8 May Top Stories]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_2.png.webp?itok=2m5Wl0MX)

![Exclusive three SBR 12 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_11.png.webp?itok=8kn_UIfA)

![SBR 3 Lorem Ipsum [ Exclusive 2]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=YCyjLegJ)

![SBR 2 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_0.png.webp?itok=_cKD-29o)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_featured_article/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=Kud35sMs)

![Event News SBR 9 Lorem Ipsum [8 may]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_8.png.webp?itok=DTh_dbYp)

![Event News SBR 9 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_7.png.webp?itok=vzDAzb6V)

![Event News SBR 8 Lorem Ipsum [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/event_news_thumbnail/public/2025-05/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_6.png.webp?itok=jvHFc4P6)

![Video [Event News]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm_0.png.webp?itok=yZnI0YBb)

![Video 1 SBR [8 May]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/video_thumbnail/public/2025-05/screenshot-2025-05-08-at-4.58.53-pm.png.webp?itok=9AAeRz_k)

Advertise

Advertise